Traveling abroad can be an exciting adventure, but it also brings its own financial challenges. For many travelers, managing taxes is one of the most overwhelming aspects of living or working outside their home country. The IRS offers comprehensive tax relief options that can help ease the financial burden, especially for U.S. citizens and residents who spend significant time abroad. This guide will walk you through how the IRS can help you navigate these complexities and ensure your tax situation is managed effectively while away.

Tax Filing for U.S. Citizens Abroad

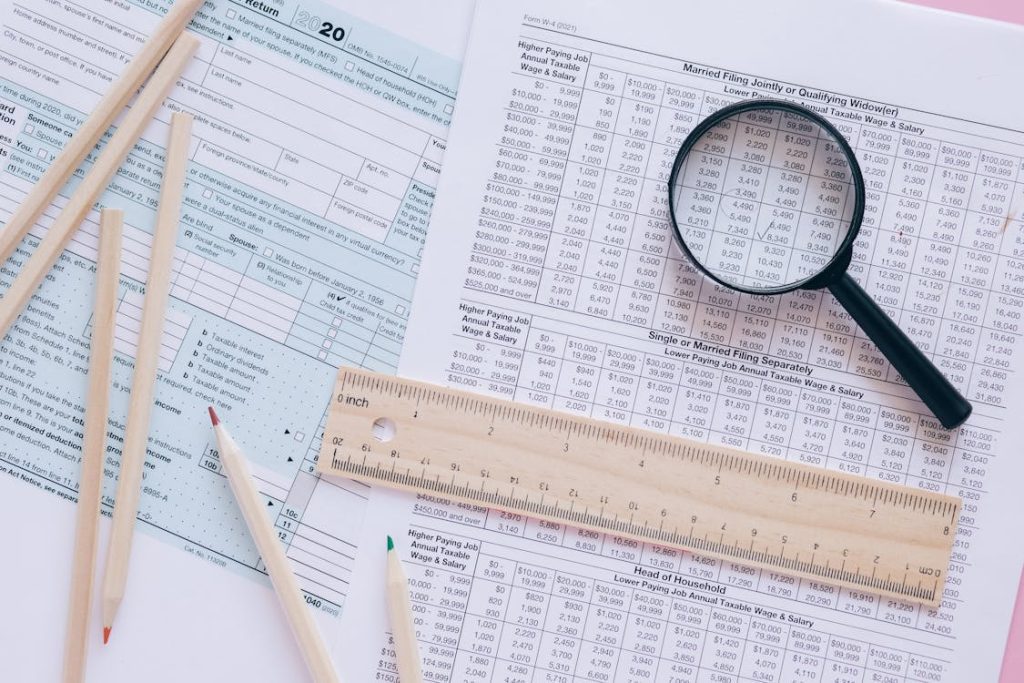

All U.S. citizens and residents who reside outside the country must submit their tax returns. Certain eligibility criteria allow qualifying taxpayers to decrease their tax burden. American expats benefit from the Foreign Earned Income Exclusion (FEIE), which is their most commonly used tax reduction option. Through this provision, individuals can protect part of their foreign income from U.S. taxation. The current FEIE regulations enable overseas workers to exclude more than $100,000 of their earned foreign income from taxation.

Taxpayers who meet the requirements can benefit from the FEIE and FTC programs. This provision allows people who work abroad to use taxes paid to foreign governments to reduce their U.S. tax liability, especially when they earn income in high-tax countries. These tax provisions help decrease the total tax responsibility of people living abroad, yet their application demands detailed eligibility tests and particular tax filing steps.

IRS Tax Relief Programs for Struggling Travelers

Some foreign travelers can access tax exclusions or credits, but others cannot afford to pay their U.S. tax obligations because of financial difficulties. IRS tax relief programs act as the solution for such situations. The IRS runs different assistance programs for taxpayers facing financial troubles while overseas. These programs have been established to help taxpayers reduce tax debt amounts while offering flexible payment methods and debt forgiveness features.

The IRS Fresh Start Program is one of the leading relief options taxpayers can use. The program enables people who cannot afford their full tax debt to get assistance. The program proves advantageous for travelers who encounter serious financial problems during their travel period because of unanticipated medical emergencies or sudden employment loss. Eligible participants in the Fresh Start Program can create payment arrangements or seek reductions on their overall tax debt, thus preventing excessive financial pressure.

Understanding Tax Relief for Expats and Nomads

Digital nomads, freelancers, and business owners running international operations need comprehensive tax relief solutions to navigate their foreign operations. Remote workers experience income instability because of their flexible work environment, making tax management challenging when there is no steady financial foundation. This understanding helps people who need clarity regarding IRS tax relief options gain the necessary support.

Taxpayers outside the United States can receive filing extensions as an essential advantage to handle U.S. tax deadlines when differences or practical challenges arise. The Internal Revenue Service automatically gives U.S. expats two months to file their tax returns, but offers additional extensions for cases that require it. The extension provides travelers additional time to examine their finances before preparing their tax returns, minimizing the possibility of penalties.

How the IRS Helps with Tax Resolution for Travelers

Taxpayers with overdue taxes can get assistance from the IRS to handle these situations while they travel abroad. Tax Resolution Services represent an effective solution for people who need to solve their tax payment backlog. The services function to assist people when they need to negotiate with the IRS about penalty reductions, payment plan setup, and tax dispute resolution stemming from foreign residency.

Conclusion

Handling taxes while living outside the United States can be managed effectively without causing excessive stress. US citizens and residents who understand tax rules and have proper access to extensive relief programs manage their international tax regulations successfully. Taxpayers can benefit from numerous relief programs and tax deductions offered by the IRS, including the Fresh Start Program and Offer in Compromise, as well as various tax exclusions and credits.