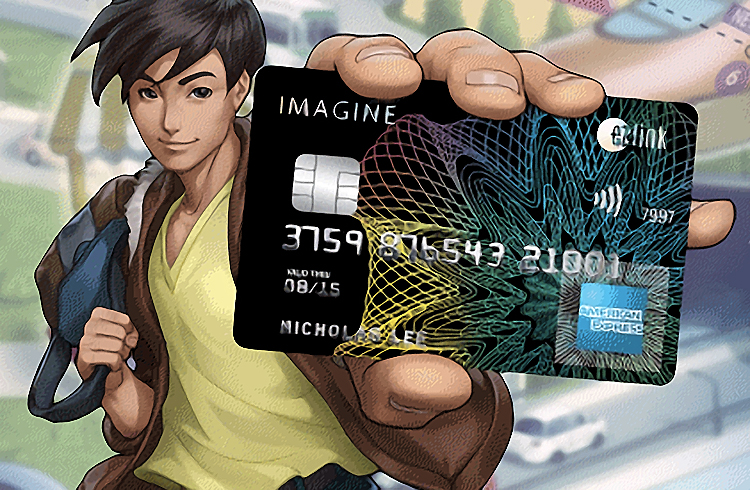

The Imagine Credit Card is a 100% digital, fee-free Visa card offered by ImaginBank, a mobile banking service by CaixaBank. It is designed for users who prefer a fully online banking experience, allowing them to manage their account directly from their smartphone.

No Annual Fees – Enjoy a credit card with zero maintenance costs.

Fully Digital – Manage everything from the Imagine app.

Contactless & Mobile Payments – Works with Apple Pay, Google Pay & Samsung Pay.

Global Acceptance – Use your card anywhere Visa is accepted.

Exclusive Discounts & Cashback – Get special deals on travel, shopping, and entertainment.

Key Benefits of the Imagine Credit Card

The Imagine Credit Card is a modern, 100% digital, fee-free card designed for convenience and security.

Here’s why it stands out:

No Annual Fees – Truly Free

- Zero maintenance costs – no annual or hidden fees.

Fully Digital & App-Based Management

- Control your card entirely from your phone via the Imagine app.

- Check your balance, track spending, and make payments anytime.

Exclusive Discounts & Cashback

- Get special deals on travel, entertainment, fashion, and more.

- Enjoy cashback rewards when shopping with select brands.

Accepted Worldwide

- Use your Imagine Visa anywhere Visa is accepted – both online and in-store.

Secure & Contactless Payments

- Supports Apple Pay, Google Pay, and Samsung Pay for seamless payments.

- Enjoy contactless tap-to-pay convenience for faster checkouts.

Virtual Card for Online Shopping

- Get an instant virtual credit card for secure online transactions.

Advanced Security & Fraud Protection

- Set spending limits, receive instant alerts, and control your card from the app.

How to Apply for the Imagine Credit Card Online

Applying for the Imagine Credit Card is a simple and fast process. Follow these steps to get started:

Visit the Official Imagine Website

Go to the official Imagine Credit Card website to start your application. Ensure you are on the official site to avoid scams.

Check Eligibility Requirements

Before applying, review the eligibility criteria, such as:

- Minimum age requirement

- Residency or income qualifications

- Credit score requirements (if applicable)

Fill Out the Online Application Form

Provide your personal details, including:

- Full name and contact information

- Address and employment details

- Income and financial information

Upload Required Documents

You may need to submit supporting documents, such as:

- Proof of identity (passport, driver’s license, or ID card)

- Proof of income (pay stubs, bank statements, or tax returns)

- Address verification (utility bill or rental agreement)

Submit Your Application

Review all the details before submitting your application. Once submitted, you will receive a confirmation email.

Wait for Approval

Processing times vary, but you may receive an instant decision or a response within a few business days.

Activate Your Card

Once approved, follow the instructions to activate your Imagine Credit Card and set up your account for online management.

No Fees, No Hassle – Why It’s a Great Choice

The Imagine Credit Card is designed for simplicity and convenience, making it an excellent option for those looking for a hassle-free credit card. Here’s why it stands out:

No Annual Fees or Hidden Charges

Unlike many credit cards, the Imagine Credit Card has no annual fees, maintenance costs, or hidden charges, helping you save money year after year.

Fully Digital and Easy to Manage

Everything is controlled through a user-friendly mobile app. You can track spending, check balances, and make payments anytime, anywhere.

Secure and Widely Accepted

Since it’s a Visa card, it’s accepted worldwide, both online and in stores. The card also supports contactless payments and mobile wallets like Apple Pay and Google Pay.

Rewards and Exclusive Discounts

Cardholders can access cashback offers, discounts, and special promotions on shopping, travel, and entertainment.

Instant Virtual Card for Online Purchases

Get a virtual version of your card immediately after approval, making it safer and more convenient for online transactions.

Manage Your Imagine Card Easily with the Mobile App

The Imagine Credit Card comes with a powerful mobile app that gives you full control over your account anytime, anywhere. Here’s how it makes managing your card effortless:

Track Your Spending in Real Time

- View real-time transactions and monitor your spending habits.

- Get instant notifications for every purchase or payment.

Make Payments with Ease

- Pay your credit card bill directly through the app.

- Set up auto-pay to avoid late fees.

Secure & Contactless Payments

- Add your card to Apple Pay, Google Pay, or Samsung Pay for quick, tap-to-pay transactions.

- Use the app to lock or unlock your card if it’s lost or stolen.

Manage Rewards & Discounts

- Check available cashback offers and exclusive discounts.

- Redeem points directly from the app.

Instant Access to Virtual Cards

- Get a virtual credit card for safe online purchases.

- Create multiple virtual cards for different types of spending.

Contactless & Secure Payments with Imagine Visa

The Imagine Visa Credit Card offers a seamless, secure, and hassle-free way to make payments.

With advanced security features and contactless technology, you can shop with confidence anywhere Visa is accepted.

Tap & Pay for Quick Transactions

- Simply tap your card on a payment terminal for fast and secure transactions.

- No need to insert your card or enter a PIN for small purchases.

Secure Mobile Wallet Integration

- Add your Imagine Visa to Apple Pay, Google Pay, or Samsung Pay for even faster payments.

- Use your smartphone or smartwatch to make purchases without carrying your physical card.

Advanced Security Features

- Real-time transaction alerts notify you of every purchase.

- Instantly freeze or unfreeze your card via the mobile app if lost or stolen.

- EMV chip technology protects against fraud and data theft.

Widely Accepted Worldwide

- Use your Imagine Visa anywhere Visa is accepted—online, in-store, or abroad.

- Enjoy secure international transactions without extra hassle.

FAQs About the Imagine Credit Card

What is the Imagine Credit Card?

The Imagine Credit Card is a fee-free, fully digital Visa card that offers secure transactions, contactless payments, and easy account management via a mobile app.

How can I apply for the Imagine Credit Card?

You can apply online through the official Imagine website or mobile app by filling out an application form and submitting the required documents.

Does the Imagine Credit Card have an annual fee?

No, the Imagine Credit Card has no annual fees, hidden charges, or maintenance costs.

Where can I use my Imagine Credit Card?

Since it’s a Visa card, it is accepted worldwide at millions of locations, including online and in-store purchases.

Can I use the Imagine Credit Card for contactless payments?

Yes! The card supports tap-to-pay transactions and is compatible with Apple Pay, Google Pay, and Samsung Pay.

How do I check my balance and transactions?

You can track your spending, view real-time transactions, and check your balance through the Imagine mobile app.

What should I do if I lose my Imagine Credit Card?

You can instantly lock or freeze your card via the mobile app. If needed, request a replacement through customer support.

Is the Imagine Credit Card safe for online shopping?

Yes! It offers a virtual card option for secure online payments and EMV chip technology to protect against fraud.

Can I earn rewards or cashback with the Imagine Credit Card?

Yes, Imagine cardholders gain access to exclusive discounts, promotions, and cashback offers at select retailers.

How do I contact customer service?

You can reach customer support through the mobile app, website, or phone number provided on the official Imagine platform.